About Us

Hall Capital, LLC is a Registered Investment Advisor which leverages the association with the Hall Family Office for the benefit of a limited number of clients. We have found that clients seek advisors who are knowledgeable, independent, client focused and trustworthy.

Knowledgeable

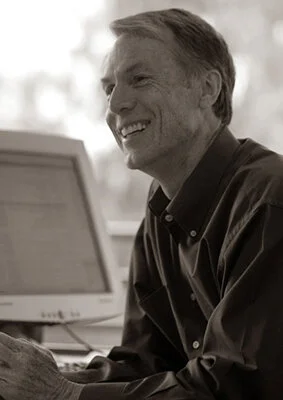

A trusted advisor is primarily an individual, whether on a team or at a large or small firm. At Hall Capital, the founder, Donald Hall is involved with all clients. He draws on his over 30 years of professional investing experience having joined Scudder Stevens & Clark as portfolio manager. He was a Managing Director of the firm, which subsequently became Zurich Scudder Investments. At the time of his departure the firm was one of the largest global asset managers in the world with $300 billion of assets under management. His portfolio management and policymaking experience spanned the firm's major business units: individual taxable portfolios, institutional tax-exempt portfolios and mutual funds.

Mr. Hall contributed to the firm-wide equity valuation and asset allocation frameworks. He conceived an equity selection strategy that attracted $3 billion in assets under management within five years. He launched an equity mutual fund, which ultimately earned a five star rating by Morningstar. He served in policy-making roles in other mutual funds as well. He chaired the firm's Asset Allocation Policy group for institutions and was Office Director in Los Angeles.

Thus, at Hall Capital we bring institutional expertise to portfolios of individuals.

Mr. Hall became a Chartered Financial Analyst (CFA) after receiving his BS in Engineering from Auburn and MBA from Harvard.

Independent

Hall Capital is small and fully autonomous. We have no outside shareholders or managers to satisfy, only our clients. We will grow only at the will of our clients. No portfolio manager will be responsible for more than 40 clients.

Client Focused

The number of clients we will take is limited as we manage each client individually, taking into account each client’s risk tolerances and tax situation. Risk tolerance is a personal issue and properly assessing a client’s tolerance to take on more risk for a higher return requires knowing the client very well. Furthermore, a client’s tax position is unique and requires individual account attention. We are a “fee only” advisor. We never charge any commissions. In the unlikely event that we were to use a mutual fund that pays a load commission, the commission is deposited to the client’s account. Thus, our investment decisions are made solely with the client’s best interests in mind. While our client portfolios are mostly comprised of conservative, liquid securities, we include "alternatives," such as illiquid, but high return, partnerships when appropriate.

TRUSTWORTHY

The investment world is full of bright, enthusiastic and frequently glib promoters. Records are promoted and expertise is asserted. However, if your advisor is not 100% trustworthy, then that advisor has no place in your financial life. As noted, we have structured the firm for the primary benefit of the client. Securities purchased for clients are also purchased by the firm owner. At Hall Capital, “we eat our own cooking.”

Dana Hoffman — Chief Operations Officer

Dana Hoffman worked in litigation consulting and then began her investment career, working for Wells Fargo Bank in their Private Asset Management division. She held positions involved with marketing, sales and portfolio management, finishing her tenure there as a Regional Investment Manager in Southern California. She was responsible for creating efficiencies and innovation to further streamline process and associated profitability while ensuring compliance with Bank and regulatory policies. She developed investment strategies for clients and provided leadership and management to a team of portfolio managers.

Subsequently she worked for State Street Bank as a Client Service Unit Manager, in charge of the west coast office and relationship management of large institutional clients including commercial terms, regulatory compliance and service level standards.

She joined Hall Capital Management in 2015 as the Chief Operations Officer handling client communication, compliance, data analysis, bookkeeping and custodial aspects for the firm.

She is a past member of the Board of Directors for State Street Trust Company of California and the Los Angeles Association of Investment Women. She holds an MBA from Pepperdine University as well as a BA in Math and Economics from Claremont McKenna College.